More banks fall as taskforce flops

Laura Williams

11 October 2022, 8:10 PM

The Gilgandra CBA branch has met its fateful end, despite the community wanting the branch to continue.

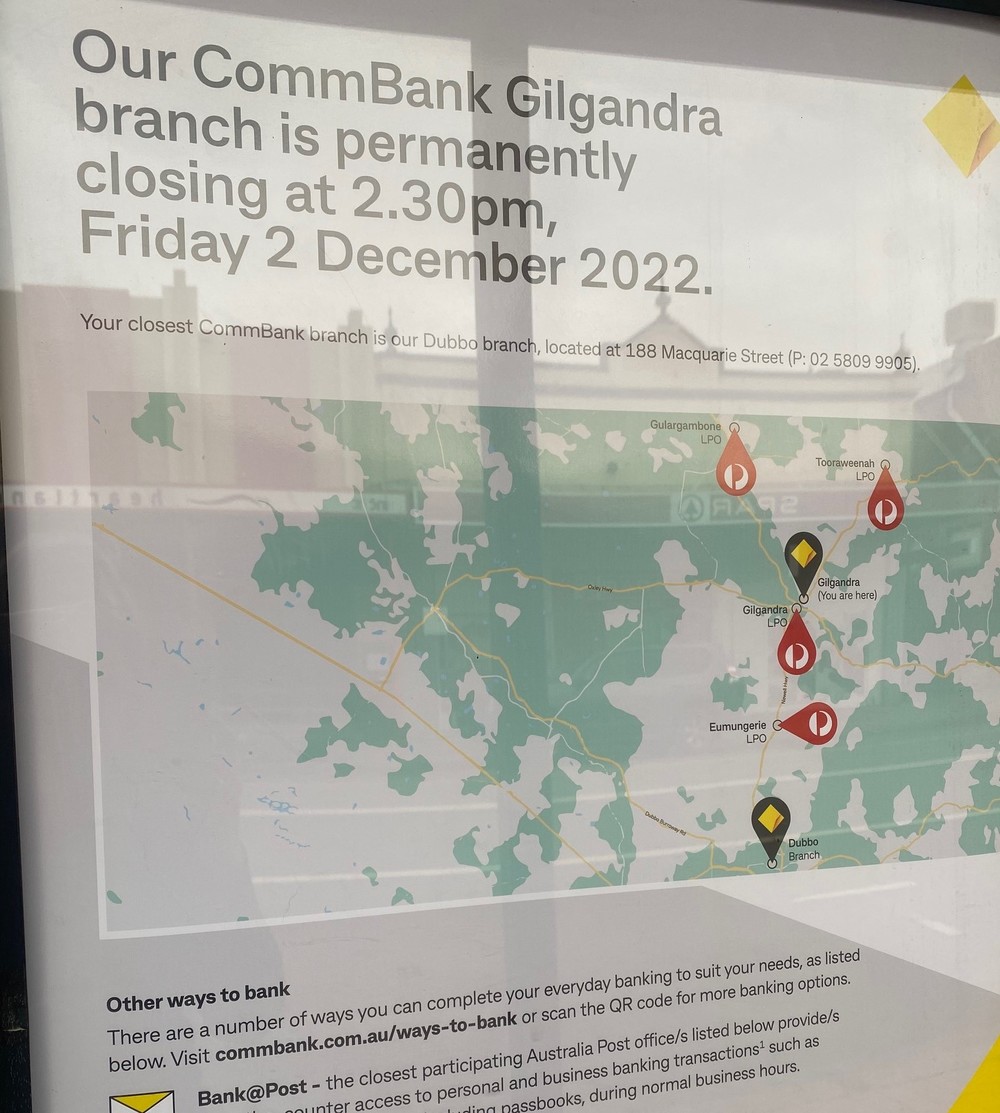

The Gilgandra CBA branch has met its fateful end, despite the community wanting the branch to continue. Gilgandra has become victim to the seemingly mass exodus of banks from regional towns, with the Commonwealth Bank of Australian (CBA) announcing that they will close the doors of the Gilgandra branch on Friday 2 December.

Mayor Doug Batten says the council was given no prior warning of the closure, something that has become a theme for the bank’s presence in Gilgandra.

“This is the third time the Commonwealth Bank has come and left Gilgandra,” Cr Batten said.

According to Cr Batten, in the early 90s the CBA announced one Friday afternoon that they would be closing their branch that very same day, leaving little warning for locals that their banking needs would need to go through the chemist shop.

When a main street blaze took hold of the chemist in 2009, the building was rebuild with designated CBA premises.

“They opened it as a quasi branch, in recent years there’s a bit of (randomness) to whether it’s open or not,” Cr Batten said.

From December, CBA customers in Gilgandra will need to do their banking through the post office service.

In 2020 the town also suffered from reduced opening hours at the National Australia Bank, which now only opens until 12:30.

The challenge for locals in regional Australia has become commonplace, as a growing presence of online banking hasn’t necessarily translated to a reduced need for branches and in-person services.

The branch offices were custom-built for the CBA after the 2009 main street fire and could be difficult to fill.

The growing upset led to the establishment of the national Regional Banking Taskforce, which when released earlier this month, with the release criticised as being ‘hidden’ in the distraction of the long weekend, and leading to more upset.

Finance Sector Union (FSU) national secretary Julia Angrisano said the union is calling on another inquiry.

“The report tabled by the so-called Taskforce needs to be pulped and we need to start again. We need a proper inquiry, not just the banks talking to themselves,” Ms Angrisano said.

A key recommendation out of the taskforce offered that banks engage more closely with local councils when considering regional branch closures.

While some are in favour of the recommendation, others are sceptical of how much that will change things.

Australian Local Government Association President Linda Scott said the recommendation could help communities transition from branch closures.

“When councils have a full picture of what is happening with branch closures then they can help communicate these decisions and alternative banking options to their community,” Ms Scott said.

Cr Batten said that even with warning, however, council doesn’t have the capacity to provide what the banks can.

“I wouldn’t know the way forward,” Cr Batten said.

“The ‘Big 4’ banks have treated the communities that have supported them for generations with contempt…they’re taking the easy way out.”.

A helpful sign in the window sends customers to other locations or other ways to bank.

The FSU is seeking laws that require banks to provide a minimum level of service to customers and ‘stop cannibalising their local branch network’.

“Don’t believe the banks when they claim customers prefer banking online. Our members tell us that the numbers of ‘over the counter’ transactions each day are counted up and once a limit is reached, customers are taken to a computer inside the branch or to an ATM outside and shown how to do their banking online,” Ms Angrisano said.

According to independent research by banking writer Dale Webster, 64 per cent of bank branches in regional Australia have closed since 1975, and of the 1226 towns that had bank branches then, only 370 remain in 2022.

Ms Angrisano said that the Taskforce refused to hear from the FSU or their members.

“The industry’s track record speaks for itself and we can expect more of the same – that’s more branches closing, more communities without banking services and bank staff without a job,” she said.

“The banks have proven that they cannot be trusted to provide a decent level of service to our community, so it’s time for the Government to step in.”