Regional banking inquiry calls for a publicly-owned bank

Lily Plass

27 May 2024, 9:20 PM

photo cred: Ellie Burgin

photo cred: Ellie BurginThe federal government's 15-month inquiry into bank closures in regional Australia handed down their findings on Friday 24 May.

Initiated by Senator Gerard Rennick and chaired by Senator Matt Canavan, the inquiry looked at the impacts of branch closures in regional areas, as well as the banks' reasoning behind the closures.

“While the use of cash is declining across the Australian economy, cash and face‑to-face banking services remain important for many residents, organisations and businesses in regional communities,” the report stated.

Measures to guarantee better banking for people in the bush and bolster regional economies should include a publicly-owned bank according to the report's recommendations.

Since the start of the inquiry in February 8, 2023, 108 regional branches closed nationwide.

According to the Financial Service Union (FSU), 29 branches have closed in Western NSW since 2017. The data is based on the banks' consultations with the FSU.

The committee recommended that the Australian government urgently develop a mandatory banking of Conduct or customer Service Code which mandate a bank to comprehensively and meaningfully consult communities prior to closing a branch as well as fully fund transition agreements and support services which guarantee access to cash and essential banking services after a branch closure.

“They’ve acted on what they’ve heard and squared up to the major banks with recommendations that, if implemented, will improve Australia’s banking system with minimum standards of conduct and service,” Australian Citizen Party Research Director Robert Barwick said.

The report continues stating that bank executives are chasing short-term financial profit by closing branches instead of recognising the long-term role banks play in strengthening the economy and social fabric of whole communities.

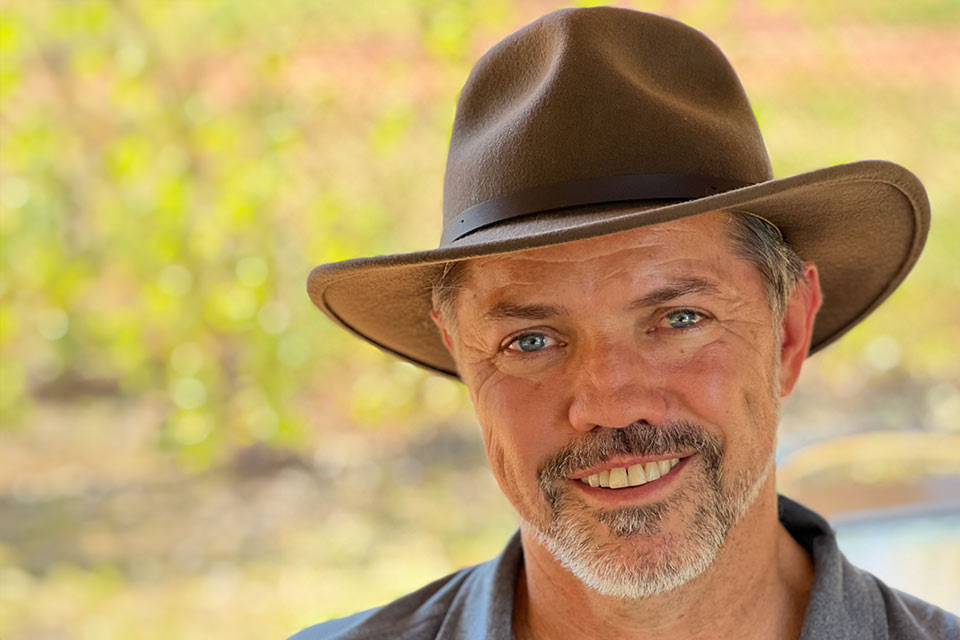

Queensland Nationals Senator Matt Canavan

Besides the direct effect of increasing travel time to bank branches, Mr Barwick said there are latent effects to the closure of banking branches in regional areas.

He said having a bank can be the lifeline for a small town because it attracts more people into town which could mean keeping a school open and bringing in more businesses.

“Commerce in small towns starts to decrease and the town begins to wither and die on the vine.”

Mr Barwick said that banks closing branches happens everywhere, however, regional and rural areas that already have less facilities are hit harder.

While post offices still offer banking services, they do not have the same range of banking services that are available at a branch. "A post office is there for your basic transactions to pay your bills, or deposit and withdraw funds. It's not a place where you can do financial management.”

“The committee has heard that many licensees are not remunerated adequately to cover the costs of providing these services, and some are making a loss. This is unsustainable,” the inquiry report states.

Senior research fellow at the school of media and communications at the Royal Melbourne Institute of Technology Dr Daniel Featherstone has worked with remote First Nations communities and done research on the digital gap project.

The digital gap project works on improving digital inclusion in remote Indigenous communities.

Especially for vulnerable groups, such as elderly people who may have less fluency in digital technology, the lack of face-to-face banking options can leave them exposed to scammers and fraudsters, according to Dr Featherstone.

"We've heard quite a number of people being impacted. Particularly Elders who used to use a bank book with paper. If they did use online banking, they tended to rely on other people that might be able to access their bank account after they've helped them use that number."

Researcher on the digital divide, Dr Daniel Featherstone. IMAGE: RMIT

"There are privacy issues associated with that. If you're trying to do banking in public or even talking to someone online, people be able to overhear your conversation or see you putting your details in." Dr Featherstone said.

"There's a lot of people who just don't have access to the internet or don't have a phone to do online banking or they don't have the skills to use online banking."

Mr Barwick gave the example of an elderly person having to go to a library to access a computer where there is an increased risk of other people seeing their banking log-in details.

“The bank will say, ‘It’s not our fault. You gave up your password and pin number," Mr Barwick said.

"We've heard from people living in remote communities where the phone signal was so poor the bank thought it was a scam call and closed their bank account because of the echo and poor quality of the mobile service they were using," Dr Featherstone said.

The committee made a second recommendation in the inquiry report suggesting the Australian government establish a publicly owned bank, similar to Kiwi Bank in New Zealand.

“This is the big game changer, the one the banks are attacking most. They won’t be able to throw an army of lawyers at finding loopholes, but will have to lift their game,” Mr Barwick said.

The committee acknowledged that it is not in the position to recommend an instant establishment of a public bank, but suggested instead the government start by including direct provision of financial services at Australia Post.